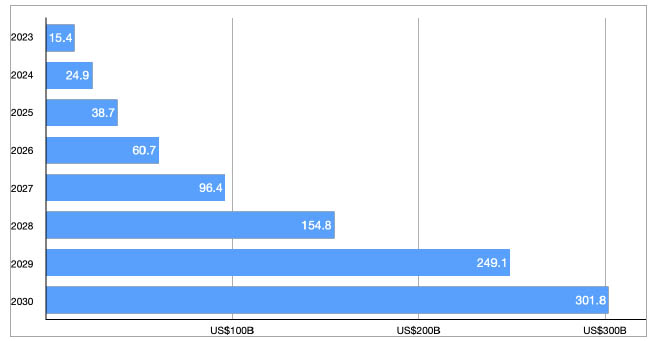

The use of AI as a preventive technique is a rising trend in the healthcare insurance market

Insurance automation such as artificial intelligence (AI) helps lower risks and fraud, encouraging business growth and automating numerous business processes to lessen overall costs.